Do you have good Hospital Management system?

Does the system have Cost centre accounting? Do

you use the functionality?

Does it have integrated Stores Management system?

Do you get the profitability information at the

Speciality unit level? (For Example: Paediatrics, Cardiology, Orthopaedics

etc.)

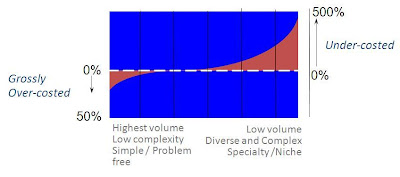

Possible scenario – Most of the major hospitals use

one or the Hospital Management System (an ERP for Hospitals). This includes the

expense management as well as used for billing the patient as per the services

utilized. Though this system has a facility to define various cost centres, the

users may not use the facility and cannot collect the expenses as per various

cost canters. If this cost centre accounting is not done, then

·

The basic and high level

profitability at the Speciality units (For Example: Paediatrics, Cardiology,

Orthopaedics etc.) is not available

·

The cost of general shared

services like HR, Admin etc. or operational shared service like Laundry,

Equipment maintenance are allocated like ‘peanut butter spread’

·

It is highly impossible to get

the Procedure level cost or patient level costs

·

The cost of items provided for

procedures like valves, stents etc. or consumables to various specialities

cannot be allocated

Do you know, how the services like HR,

Administration, IT, Laundry, Maintenance etc. are consumed by others?

Possible Scenario – As the Activity Based Costing

(ABC) methodology is not adopted by the Hospital it is not possible for them to

get information on this. The ABC methodology would provide them the information

on

·

What are the different services

provided by the shared service departments

·

What is the cost of each

service?

·

Can the non-core and high value

service be outsourced?

Do you know the cost of Procedures within each

speciality area?

Possible Scenario – The hospital may be calculating

those costs at a very high level by collecting in the information of the cost

that is directly attributable to the procedure like specialist fees, external

services hired, consumables etc. This may not the total cost of the procedure

as all other indirect cost are not known or cannot be allocated accurately.

The ABC methodology can calculate the cost of each

procedure based on the activities performed by the speciality department or any

other shared services. This would lead to accurate information of procedures

and find the profitability of the procedures. If there are multiple hospitals

in a group

then the cost of procedures can be compared across

various hospitals and the reasons for the differences can be identified. It can

also lead to the understanding of the ‘non-value added’ activities in the

procedures and can be eliminated to improve profitability.

Do you know the profitability by patient?

Possible scenarios - The hospital may know the

services provided to each patient and at the end, billing done by each service.

The hospital may not know the cost of each service and hence, what is the

profitability by each patient. The ABC methodology provides the cost of each

service loaded with the shared service cost which in turn provides accurate

information on patient level profitability. Though for hospitals the patient

may not repeat this information of patient level profitability can be used by groping

the patients by their demographic information available like age, disease,

procedures provided, life-stage, income group etc. This profiling would help

the hospital to find which patient segments are profitable across which

speciality areas and then try acquire them preferentially.

Do you know the utilization of various speciality

areas?

Can you plan your resource requirement for the

future?

Possible scenario – The hospital has to invest

heavily in the infrastructure to provide various special services to the

patients. Not all the service areas are utilized completely. The hospital may

know the capacity of the speciality area at a very high level and the

utilization also would be known at a gross level. ABC methodology can possibly

define the capacity of the infrastructure at a detail level. The same can help

the hospital to predict the resource requirement in future based on the

expected demand for various speciality areas.

Do you know the cost of acquiring a patient using

multiple channels?

Possible

scenario – The hospital may be using various channels to acquire the patients.

Those could be

a) Hospital OPD (Outpatient department)

b) Referrals

c) Direct (Generally called ‘walk-in’, but may not be

the same case hereJ)

·

Accident

·

Criminal

The cost of acquisition for those patients may not be

known to hospital, except for the direct services charged paid.

The ABC methodology can provide the cost of running

those channels as well as total cost for acquiring a patient using this

channel. Like cost of acquisition, there may be a possibility the cost of

closure (payment and discharge activities) different for the patients acquired.

The same can be identified and used for providing the direct or indirect

benefits to the channel partners.