Now a day one can hear about the term Enterprise Performance Management (EPM) a lot of times in different ways. It also termed in different ways like CPM, EPM, PM etc. Sometimes it is also used interchangeably with the individual performance and organizational performance. There are various definitions also for EPM. I personally like the definition by Gary Cokins, which mentions that Performance Management is the process of managing the execution of an organization’s strategy. It integrates the business improvement methodologies with technology. So it is neither the methodologies only nor the technology in isolation.

As I have mentioned in my earlier posts, Activity Based Management (ABM) is the way to manage your business by managing the activities to provide improved value to the customer or organizational performance. After these definitions, we will try to see how these two things go together in different ways as concepts, execution and technology.

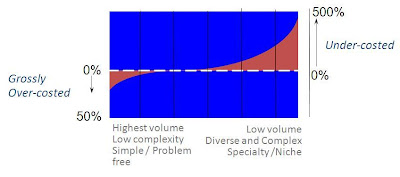

I personally believe that the EPM starts with the definition of the strategy. This is because if you do not know where you want to go, any way is a good way. Let us have a look at the following figure:

Defining the strategy for your organization, preparing business plan according to the strategy and then measuring the performance and analyzing the variances with reasons to modify the internal processes or strategy is a cyclic process. ABM fits into the ‘Measure and Analyze’ part of the cycle. Here the ABM model based on the business plan can provide the information on the resource requirement in the future as well measure the actual performance. Once you analyze the actual performance against the planned one, the same can be analyzed using various techniques like root cause analysis, continuous improvement etc. The analysis will tell whether one has to manage the processes to improve the customer value or organizational performance.

The performance management is also seen as the operational performance management or strategic performance management, as it is mentioned in the earlier part.

Operational performance management is looking at the processes to improve organizational performance and strategic performance management is looking at the processes to improve the value to the customer. The ABM model can be designed to manage the performance at both the levels. It can also be used for some tactical purposes as managing a customer segment or a product group etc.

Looking at all those things the tool vendors have combined their software solutions into one group as Enterprise Performance Management (EPM) suite. This suite generally includes the solutions for Strategy Management, Business Planning and Profitability & Cost Management. They project and try to sell these solutions as a suite. I have got the following figure from some document that I am not able remember, so please acknowledge the efforts of the person who has created it (if somebody knows it pl let me know, so that I can put the name in the acknowledgement).

In a very simple way, we will try to understand this diagram. It shows three differnet parts. Analytical toos as in the technological part that help us to alanyze the results. One may argue as to reporting is not exactly same as analytics. The second part is the analytical appliactions which are actually the software solutions based on the various business improvement methodologies. The third part is supporting tools ahich ehlp us to integrate the data and perform the administrative part for those solutions. All these solutions work on the same data mart or warehouse so as to provide one view of the data and these solutions use and provide data to the othersolutions through this data mart or warehouse.

If we see the Strategy Management methodology creates a strategy map, the Key Performance Indicators (KPIs) and corresponding action plans. Based on the strategic plan the budgeting and planning solution can create the business plan. It can also use the Profitability management solution (ABM) to create a driver based planning. ABM can also provide the actual values for various KPIs defined. The Activity analysis using the cost drivers and performance measures can provide information the performance of the organization vis-à-vis the planned one.

As we saw ABM fits into Enterprise Performance Management (EPM), conceptually as well as technologically and helps the organization to manage the performance at the strategic level as well as operational level (including the tactical one).